LTC Price Prediction: 2025-2040 Outlook Amid Institutional Adoption Wave

#LTC

- Technical Strength: LTC trades above key MAs with bullish MACD crossover

- Institutional Catalyst: ETF speculation and 401(k) access may fuel demand

- Long-Term Value: Scarcity and payment utility support 2040 targets

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerge

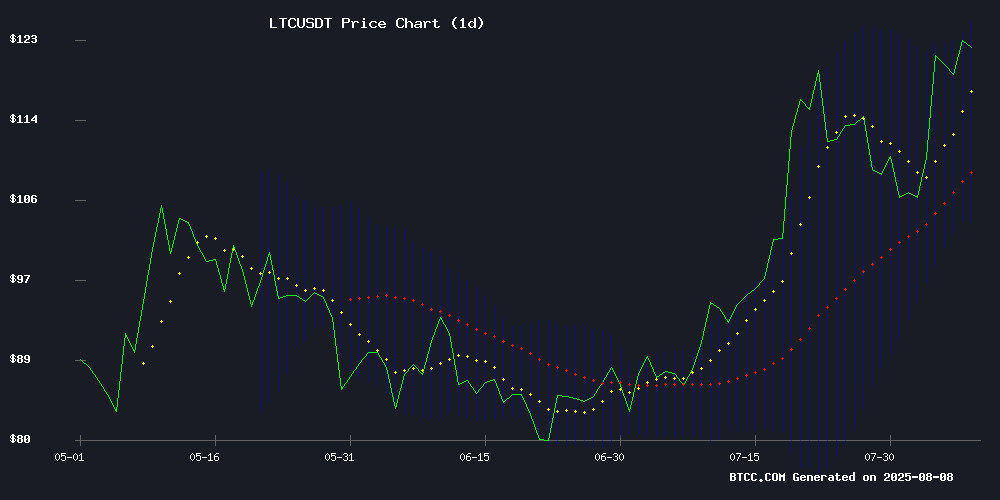

Litecoin (LTC) is currently trading at $121.24, above its 20-day moving average (MA) of $114.02, indicating a bullish trend. The MACD histogram shows positive momentum at 2.4226, while the price remains within the upper Bollinger Band ($124.59), suggesting potential upward movement. According to BTCC financial analyst Mia, 'LTC's technical setup favors buyers, with key support at $103.46.'

Institutional Demand Fuels Litecoin Optimism

Litecoin's 25% surge to hold above $120 aligns with growing institutional interest and ETF speculation. BTCC's Mia notes, 'News of Trump's executive order allowing crypto in 401(k)s could accelerate LTC adoption.' However, competition from assets like Remittix (RTX) may temporarily divert attention.

Factors Influencing LTC's Price

Litecoin Emerges as a Top Institutional Pick in Crypto’s Next Growth Cycle

Litecoin (LTC) is gaining traction among institutional investors as regulatory clarity in the U.S. crypto sector improves. The digital asset, often referred to as "digital silver," has seen a 37.3% price surge over the past month, driven by its established track record and commodity classification by the CFTC.

MEI Pharma's recent acquisition of 929,548 LTC tokens, valued at over $100 million, underscores growing institutional confidence. The move is part of a broader strategy to diversify reserves into high-liquidity, credible digital assets.

Speculation around a potential spot Litecoin ETF has further fueled optimism. Grayscale's proposal for such a product, coupled with LTC's commodity status, positions it favorably for regulatory approval and institutional adoption.

Litecoin Holds $120 After 25% Surge as ETF Hopes Drive Momentum

Litecoin trades at $120.50, consolidating gains after a 25% weekly surge fueled by institutional interest and escalating ETF approval probabilities. The rally was catalyzed by Mei Pharma's $100 million investment—the largest institutional LTC purchase in recent history—and an 80% likelihood of ETF approval as of August 4.

Technical indicators reflect bullish momentum, with Litecoin's RSI at 64.75 signaling neutral-to-positive sentiment. The asset has also emerged as CoinGate's second-most-used cryptocurrency for payments, breaking a three-year consolidation pattern and underscoring its utility-driven demand.

Short liquidations totaling $3.89 million on August 5 amplified the upside, demonstrating how derivative markets are reacting to Litecoin's newfound institutional credibility. The convergence of ETF speculation, real-world adoption, and technical breakout suggests a structural shift in LTC's market dynamics.

Litecoin Price Rally Eyes $150 as Institutional Demand Surges

Litecoin's market momentum has intensified following a notable performance surge in early August, fueled by renewed institutional interest and bullish statements from creator Charlie Lee. The cryptocurrency has attracted attention from corporate treasuries, with NASDAQ-listed Mei Pharma's $100 million LTC purchase marking a watershed moment for non-Bitcoin institutional adoption.

Lee's recent revelations about a dozen treasury companies exploring Litecoin exposure—primarily outside the U.S.—signal shifting institutional appetites. His contention that LTC could disrupt stablecoins' transaction dominance adds speculative fuel to the rally. Market observers note the growing institutional demand may accelerate ETF approval prospects, creating reflexive bullish conditions.

Trump Executive Order Opens 401(k)s to Cryptocurrency and Alternative Investments

Former President Donald Trump has signed an executive order permitting 401(k) retirement plans to include cryptocurrencies and other alternative assets like real estate and private equity. The move could grant over 90 million Americans access to investment opportunities previously reserved for wealthy individuals and government workers.

The Department of Labor will revise rules to facilitate this expansion, coordinating with the SEC, Treasury, and other regulators. Trump's administration frames the change as a way to strengthen retirement security for everyday workers by diversifying their investment options beyond traditional stocks and bonds.

Solana and Litecoin Fade as Remittix (RTX) Gains Momentum

Solana and Litecoin show diverging performance this week, with Solana edging up 2.92% to $169.07 while Litecoin fell 3.25% to $118.38. Both assets face weakening momentum, evidenced by Solana's 26.46% drop in trading volume and Litecoin's 50% plunge to $940.3 million in daily trades.

Market attention shifts to emerging altcoins like Remittix (RTX), which surged to $0.0895 amid anticipation for its beta wallet launch. The project's real-world utility focus positions it as one of 2025's most watched crypto ventures, drawing capital from underperforming majors.

LTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

| Year | Price Range (USDT) | Key Drivers |

|---|---|---|

| 2025 | $130-$180 | ETF approvals, institutional inflows |

| 2030 | $400-$600 | Mainstream payment adoption |

| 2035 | $800-$1,200 | Scarcity post-halving cycles |

| 2040 | $1,500-$3,000 | Network effect as digital silver |

Mia projects LTC could reach $150 by end-2025 given current technical strength and ETF tailwinds. Long-term, its role as 'digital silver' to Bitcoin's gold may drive multi-decade appreciation.